Running a sustainable business isn’t just about what you sell or how you source. It’s a mindset woven into every decision—from your supply chain to your office compost bin. But here’s a question that often gets overlooked in the rush to do good: how do you protect it all?

Honestly, insurance might seem like the least “green” topic. It feels like paperwork and fine print. Yet, think of it this way: your insurance plan is the safety net that lets your business walk the high-wire of innovation. Without the right coverage, one storm—literal or financial—could undo years of positive impact.

Let’s dive into the unique risks green businesses face and how to build an insurance plan that doesn’t just cover your assets, but actually aligns with your core values.

Why Green Businesses Face Unique Risks

You know the drill. You’re not a typical company. Your risk profile has some special contours. A standard business owner’s policy (BOP) is a good start, sure, but it’s like wearing a raincoat in a blizzard; it might not be enough for the specific weather you’re in.

The Innovation Gap & New Technologies

Many sustainable ventures are built on new tech—think bio-based materials, novel recycling processes, or specialized solar installations. The problem? Traditional insurance carriers can be hesitant to cover technologies they deem “unproven.” This creates a protection gap right where you need it most.

Supply Chain Complexity and Reputation Reliance

Your brand is built on trust and transparency. If a supplier fails to meet your ethical or environmental standards—even if you weren’t directly at fault—the reputational damage can be severe. A single negative story can spiral. And what about your often longer, more specialized supply chains? They can be more vulnerable to climate-related disruptions.

Green Assets Need Green Coverage

Your assets might include a rooftop garden, a fleet of electric delivery vans, or expensive on-site water reclamation systems. These aren’t always adequately valued or even listed in a standard property policy. If a hailstorm damages your solar panels, will your policy cover the full cost of replacement with like-kind, efficient technology?

Building Your Sustainable Insurance Portfolio

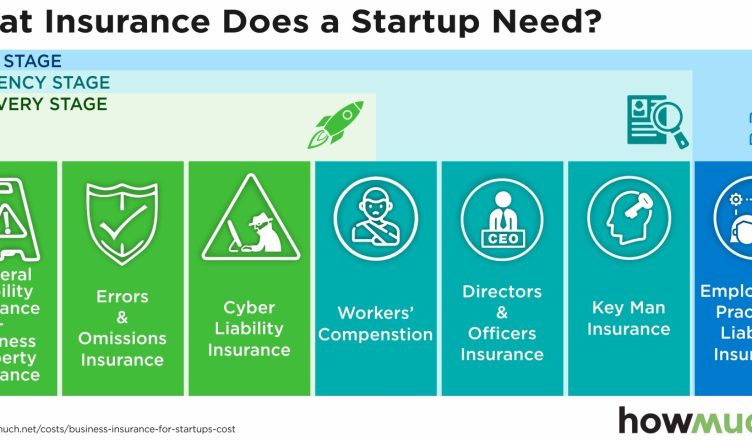

Okay, so we’ve seen the challenges. Here’s the deal: crafting the right plan means looking beyond the checkbox. It’s about proactive conversation with your broker. Here are the key coverages to discuss.

1. The Non-Negotiable Foundation

Every business needs these, but review them through a green lens:

- General Liability: Covers third-party bodily injury or property damage. Crucial if customers visit your site.

- Commercial Property: Ensure it includes “green rebuild” or “functional replacement cost” clauses. This means if your eco-friendly building is damaged, they pay to rebuild it to the same sustainable standard, not just to basic code.

- Business Interruption: A lifesaver. If a covered event shuts you down, this replaces lost income. For a business with tight margins or seasonal cycles, this is critical.

2. The Specialized Protections

This is where your plan gets its unique character.

- Professional Liability (Errors & Omissions): Essential for consultants, architects, engineers, or anyone giving green advice. If a client claims your sustainability strategy failed to deliver promised results, this defends you.

- Environmental Liability/Impairment: Even the greenest operation can have an accident—a spill, a leak. This covers cleanup costs and third-party damage, going where general liability policies typically exclude.

- Cyber Liability: You collect data. Maybe on energy usage, customer habits. A breach could devastate trust. This covers response costs, notification, and recovery.

- Directors & Officers (D&O) Insurance: Protects your leadership if they’re sued for decisions that affect the company’s value. Given that sustainable businesses sometimes prioritize purpose alongside profit, this layer is vital.

3. The Forward-Thinking Add-Ons

These reflect the evolving nature of risk.

- Supply Chain Disruption: Can be tailored for climate-related interruptions, like a flood at a key supplier’s only facility.

- Reputational Risk: A newer product that helps fund PR efforts to rebuild your brand after a damaging event.

- Certification Defense: Some insurers offer support if your organic, B Corp, or other green certification is challenged.

Choosing a Carrier That Gets It

You wouldn’t partner with a supplier who uses coal power, right? So why partner with an insurer invested in fossil fuels? The movement towards ESG (Environmental, Social, Governance) investing is hitting the insurance world—these are the long-tail keywords savvy businesses are searching for. Look for carriers who:

- Have publicly stated ESG commitments.

- Offer premium discounts for LEED-certified buildings or safe operational practices.

- Underwrite renewable energy projects.

- Ask the right questions. A good broker or agent will want to understand your mission, not just your square footage.

It’s not just about feeling good. Aligning with such a carrier can mean better risk assessment and more tailored coverage. They simply understand what you’re building.

A Quick Glance: Core Coverages for Green Ventures

| Coverage Type | What It Protects | Green Business Consideration |

| Commercial Property | Building, inventory, equipment | Insist on “green rebuild” clause |

| General Liability | 3rd-party injury/property damage | Standard, but review limits for public events |

| Business Interruption | Lost income after a covered event | Calculate based on true earning potential |

| Environmental Liability | Pollution cleanup & 3rd-party damage | Critical even for low-risk operations |

| Professional Liability | Claims of negligence in services/advice | Must-have for consultants & green tech firms |

The Final Word: Insurance as an Extension of Your Ethos

In the end, sustainable insurance planning isn’t a distraction from your mission. It’s a profound commitment to it. It’s the acknowledgment that to create lasting change, you must be resilient. You have to endure.

By taking the time to align your coverage with your values, you’re not just buying a policy. You’re fortifying your entire operation. You’re ensuring that the good you’re putting into the world has a fighting chance to stick around, grow, and inspire others—no matter what comes your way.

That’s the real ROI: peace of mind, and the durability of your impact.