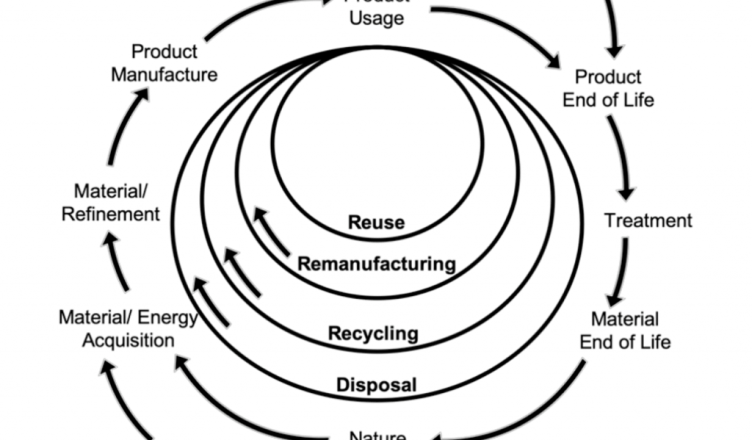

Let’s be honest—the way we make, use, and toss stuff is broken. It’s a linear system on a round planet, and frankly, it’s running out of road. That’s why the circular economy isn’t just a buzzword; it’s a full-blown business revolution. And at its heart? Models like Product-as-a-Service (PaaS), where you lease a drill for the holes you need instead of buying a dust-collector for your garage.

But here’s the deal: when your business model turns products into long-term services and assets into loops, traditional insurance starts to look, well, a bit straight-lined. You need specialty coverage that bends without breaking.

Why General Liability Isn’t Enough Anymore

Think of a standard business insurance policy like an umbrella. It’s great for a predictable drizzle. But if you’re operating a PaaS company—renting out high-end electronics, leasing industrial machinery, or offering furniture on a subscription—you’re not in a drizzle. You’re in a dynamic storm of unique risks.

The asset (the product) is now a revenue-generating service tool. It leaves your possession, comes back, gets refurbished, and goes out again. And again. Each handoff, each repair, each month of use is a new exposure. A standard policy might see a “laptop” as a one-time property loss. You see it as the loss of 36 months of subscription revenue plus a damaged customer relationship.

The Core Gaps in Traditional Policies

- Product Performance & Downtime: What if your leased software or smart device fails and halts your client’s operations? You could be liable for their business interruption.

- Recirculated Product Liability: Liability doesn’t end after the first use. If a refurbished component in a leased medical device fails, who’s responsible? The chain gets murky.

- Asset Value Fluctuation: The value of your circular asset isn’t its purchase price—it’s its future earning potential. Traditional property insurance often misses this entirely.

Building Your Coverage Loop: Key Policies to Consider

Okay, so what does this new safety net look like? It’s a blend of tailored, sometimes hybrid, policies. Let’s dive into the specifics.

1. Inland Marine “Float” Coverage (For the Journey)

Don’t let the name fool you. This isn’t about boats. Inland marine coverage protects property that’s on the move—which is exactly where your products are. It covers assets while in transit, at the customer’s site, and during the return loop. It’s the essential policy for anything that, you know, travels.

2. Contingent Liability & Enhanced Products Liability

This is a big one. You need liability coverage that acknowledges the life cycle of your product. It should protect you if a claim arises from a product you leased but didn’t manufacture, or from a failure that occurs after multiple use cycles. It’s about layering protection along the entire chain of custody.

3. Professional & Cyber Liability (The Silent Risks)

If your service includes data analytics, predictive maintenance, or software platforms (and most modern PaaS models do), you’re a tech company too. An error in your service algorithm or a data breach exposing client information isn’t covered by general liability. That’s a professional or cyber risk. You can’t ignore it.

A Quick Guide to Risk Mitigation & Coverage

| Business Activity | Primary Risk | Specialty Coverage Consideration |

| Leasing/renting physical goods (tools, appliances, furniture) | Damage to asset in customer’s possession; theft; loss of revenue. | Inland Marine; Bailee’s Coverage; Business Interruption for lost lease payments. |

| Offering performance-based outcomes (e.g., “pay for cooling hours”) | Failure to meet service-level agreement (SLA); client’s business downtime. | Contingent Business Interruption; Professional Liability (Errors & Omissions). |

| Refurbishing & remanufacturing products for reuse | Liability from refurbished part failure; environmental handling risks. | Pollution Liability; Enhanced Products-Completed Operations coverage. |

| Managing product take-back & reverse logistics | Damage during return shipping; warehouse inventory shrinkage. | Inland Marine (for transit); Warehouse Legal Liability coverage. |

Finding the Right Partner (It’s Not Just About Price)

You won’t find this coverage by just clicking a “get quote” button on a generic site. You need a broker or carrier who gets it. Look for insurers with experience in tech E&O, equipment leasing, or even the sharing economy—they’re already thinking in this direction. Ask them point-blank: “How do you handle multi-cycle product liability?” or “Can you insure based on projected revenue, not just asset cost?” Their answers will tell you everything.

And a quick, human tip: document everything. The condition of assets pre- and post-lease, your refurbishment processes, your SLAs. This isn’t just good ops; it’s your best defense during a claim. It shows the insurer you’re managing the risk, not just hoping it away.

The Bottom Line: Insurance as an Enabler

For a long time, insurance felt like a tax on innovation—a rigid set of rules for a static world. But for the circular economy, the right specialty coverage is the opposite. It’s the foundational layer that allows you to experiment, to scale, and to take the smart risks that this new model demands. It turns a potential vulnerability into a core component of resilience.

Ultimately, building a business that’s designed to last—where products have multiple lives and value is created through service—requires a financial backbone that’s just as adaptable. Your insurance shouldn’t be a relic of the linear past. It should be a strategic tool, helping you close the loop with confidence.